Earnings taxes can hinder wealth creation. Luckily, for People searching for to save lots of on taxes, there are 9 states with out revenue tax the place we will select to reside. These states are listed beneath in alphabetical order:

- Alaska

- Florida

- New Hampshire

- Nevada

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

Ideally, you will safe a unbelievable job and discover your soulmate in one in all these 9 revenue tax-free states. As your revenue grows over time, you will save extra by avoiding state revenue taxes.

Once you retire, you in all probability will not have to relocate as a result of no revenue tax often means tax-free Social Safety advantages, IRA or 401(ok) withdrawals, and pension payouts. The truth is, there at the moment are 41 states that don’t tax Social Security benefits after Missouri and Nebraska determined to cease taxing Social Safety advantages in 2024.

When you turn into rich, you may also contemplate states that don’t tax estates or inheritances. Fortunately, most states with out state revenue taxes additionally exempt estates and inheritances from taxation.

Subsequently, if you wish to get wealthy and save on taxes, it is useful for individuals early of their careers to review state taxation charges. As you age, no matter how excessive the state revenue tax fee is, it turns into more and more difficult to maneuver because of the community you’ve got established.

Excessive-Paying Jobs Have a tendency To Be In Excessive Earnings Tax States

Regrettably, many of the highest-paying jobs are usually concentrated in states with the very best revenue taxes, equivalent to California, New York, New Jersey, and Connecticut. These states function main hubs for industries like expertise, finance, and administration consulting.

Upon graduating from faculty, my solely job supply got here from New York Metropolis, the place a further metropolis tax starting from 3% to three.87% is imposed. Regardless of my makes an attempt to safe a consulting place at corporations like Deloitte, KPMG, or Andersen Consulting in Virginia, one other state with comparatively excessive revenue taxes, I could not progress past the preliminary interview levels.

Whereas the concept of avoiding state revenue tax could seem engaging, particularly for people with excessive incomes, perceive that there is not any free lunch. States with out revenue tax nonetheless require income to fund important providers like infrastructure, training, and emergency providers. This funding is primarily sourced from gross sales, property, and property taxes.

When you intend to invest in a home, a vital step in the direction of long-term wealth accumulation, it is important to think about property tax charges throughout states. Word that states like Texas, Florida, and New Hampshire, which don’t acquire state revenue taxes, usually compensate by larger property taxes.

The Finest No Earnings Tax States To Work And Get Wealthy

I’ve determined to rank the perfect 9 no revenue tax states into three buckets, from worst to finest. The variables embrace money-making alternatives, climate, different taxes charges, leisure, meals, and tradition. The primary three variables are extra goal than the final.

Bucket #3: The Least Engaging No State Earnings Tax States

Alaska (Republican leaning)

Alaska boasts beautiful pure magnificence, making it a paradise for nature fanatics. Nevertheless, the state’s harsh winters, restricted meals selection, sparse leisure choices (equivalent to no main sports activities groups), and heavy reliance on oil revenues, which account for 85 % of the state finances, pose important challenges.

Aside from the oil and gasoline sector, there are few different profitable industries in Alaska. You possibly can work within the tourism business, nevertheless it’s onerous to get wealthy, except you personal the main tourism firm.

Whereas Alaska is without doubt one of the 5 states with out a state gross sales tax, native jurisdictions have the authority to impose gross sales taxes, which may attain as much as 7.5%. The typical property tax fee in Alaska stands at 1.18%, surpassing the nationwide common. Regardless of a comparatively inexpensive median house value of round $369,000 in Anchorage in response to Zillow, there are not any inheritance or property taxes within the state.

Throughout the summer time months, Alaska presents unparalleled points of interest, with Denali Nationwide Park being a standout vacation spot. Nevertheless, the state’s isolation and restricted availability of high-paying jobs forestall it from being a best choice amongst no-income-tax states for employment.

South Dakota (Republican leaning)

When you’re a fan of pheasant looking, South Dakota within the fall is good. Likewise, when you take pleasure in fly-fishing for trout within the Black Hills or fishing within the dammed-up lakes alongside the Missouri River, which nearly bisects the state, you will discover lots to understand. Moreover, the Black Hills supply wonderful alternatives for mountaineering, mountain biking, and tenting for 3 out of the 4 seasons.

Nevertheless, winters in South Dakota are lengthy and harsh. They will start as early as October or as late as January, bringing with them weeks of bitterly chilly temperatures starting from -20 to -40 levels beneath zero, with wind chills making it really feel even colder.

South Dakota’s largest industries by income embrace hospitals, corn, wheat, soybean wholesaling, and meat, beef, and poultry processing, which collectively generated billions of {dollars} in 2023. However when you’re an everyday employee in these industries, it will be onerous to get wealthy.You must personal the companies to make a fortune.

Concerning taxes, the state imposes a 4.5% gross sales tax. Localities have the authority so as to add as much as a further 4.5%, leading to a median mixed fee of 6.4%, which falls beneath the nationwide common.

The typical property tax fee in South Dakota is 1.32%, rating fifteenth in response to the Tax Basis. Regardless of this, the median value for a house in Sioux Falls is inexpensive, standing at solely $325,000 in response to Zillow. Moreover, South Dakota doesn’t have inheritance or property taxes.

New Hampshire (Democrat leaning)

New Hampshire is yet one more beautiful state that gives unbelievable outside actions all through the spring, summer time, and fall seasons. From mountains to oceans, lakes, ponds, rivers, and woods, the state is a haven for outside fanatics. Whether or not you take pleasure in mountaineering, snowboarding, swimming, canoeing, kayaking, looking, fishing, snowmobiling, ATVing, or taking within the vibrant fall foliage, New Hampshire has all of it. Plus, it has a comparatively non-humid local weather, loads of sunny days, and every thing inside a brief drive.

Along with not having a state revenue tax, New Hampshire doesn’t tax earned revenue. Nevertheless, there may be at the moment a 5% tax on dividends and curiosity exceeding $2,400 for people ($4,800 for joint filers). Luckily, this tax is step by step being phased out, reducing to three% in 2024, 2% in 2025, and 1% in 2026, with full repeal scheduled for January 1, 2027.

On the draw back, New Hampshire has a median property tax fee of two.15%, rating third in response to the Tax Basis. Subsequently, when you’re contemplating a transfer to New Hampshire, renting as a substitute of shopping for could also be a extra prudent choice. Nevertheless, the state doesn’t impose inheritance or property taxes.

New Hampshire’s largest industries by income embrace faculties and universities, hospitals, and property, casualty, and direct insurance coverage, which collectively generated billions of {dollars} in 2023. If these industries do not align along with your pursuits, discovering a high-paying job in New Hampshire could show difficult.

Bucket #2: The Second Finest Group Of States With No State Earnings Taxes

Tennessee (Republican majority)

Tennessee, a landlocked state within the U.S. South, boasts vibrant cultural hubs like Nashville and Memphis. Nashville, the capital, is famend for its nation music scene, that includes iconic venues just like the Grand Ole Opry and the Nation Music Corridor of Fame. In the meantime, Memphis is legendary for points of interest like Graceland and Solar Studio, pivotal to the legacies of Elvis Presley and rock ‘n’ roll.

The state imposes a 7% gross sales tax, with a further 2.75% state tax on single merchandise gross sales starting from $1,600 to $3,200. Localities can tack on as much as 2.75%, leading to a median mixed state and native fee of 9.55%, the second-highest within the nation. Nevertheless, native taxes are capped, with solely the primary $1,600 of any single merchandise being taxable.

Property tax charges common 0.75%, rating thirty eighth in response to the Tax Basis. The median house value in Nashville hovers round $452,000, roughly the nationwide common. Nevertheless, the median house value in Memphis is simply $152,000 in response to Zillow! Tennessee doesn’t impose inheritance or property taxes.

Tennessee experiences diversified climates, with delicate winters within the western half and cooler winters within the east as a result of its proximity to the Appalachian Mountains. Nashville usually sees mild frosts in January, with common lows of 28°F and highs of 47°F, whereas Memphis experiences common lows of 33°F and highs of fifty°F. Each areas fall inside USDA Hardiness Zone 7a, the place snowfall is rare and barely lasts various days.

Wyoming (Republican leaning)

When Wyoming involves thoughts, Jackson Gap usually takes heart stage as a ski destination favored by many prosperous people. I as soon as had a shopper who moved from San Francisco to Jackson Gap together with his spouse and triplets to scale back their tax burden.

Wyoming’s attract extends past tax benefits; it is a breathtaking state providing a few of the best outside experiences. From the majestic Grand Teton and Yellowstone Nationwide Parks, house to iconic landmarks like Previous Trustworthy and Devils Tower, Wyoming is a haven for nature fanatics.

The state’s financial system is closely reliant on mining and agriculture, notably beef cattle and sheep farming. Moreover, Wyoming’s tourism business is prospering, catering to tens of millions of holiday makers who flock to its parks and historic websites. Nevertheless, incomes a considerable revenue in Wyoming might be difficult except you are capable of work remotely in finance or tech.

Wyoming imposes a 4% state gross sales tax, with municipalities licensed so as to add as much as 2%, leading to a mixed fee of 5.36%, the seventh-lowest within the nation in response to the Tax Basis.

Property taxes in Wyoming are among the many lowest within the nation, averaging simply 0.61% and rating forty fourth. For example, the median house value in Cheyenne stands at a modest $354,000 in response to Zillow. Nevertheless, in Jackson Gap, the place many prosperous people relocate for tax functions, the median house value soars to round $2.6 million. Notably, Wyoming doesn’t levy inheritance or property taxes.

Washington (Democratic majority)

Situated within the Pacific Northwest, Washington is thought for its wet and overcast climate, though its summers are usually heat and dry, superb for outside actions. Seattle, usually in comparison with a smaller model of San Francisco, is a hub for high-paying jobs and leisure alternatives.

Regardless of its enchantment, Washington falls wanting being a high vacation spot for these searching for states with no revenue tax, primarily as a result of its excessive median house costs. For instance, Seattle, the place many high-paying jobs are concentrated, boasts a median house value of roughly $890,000 in response to Zillow. Nevertheless, neighboring Tacoma presents extra inexpensive housing, with a median house value just under $500,000.

Washington imposes a 6.50% state gross sales tax, with a most native gross sales tax fee of 4.10%. The typical mixed state and native gross sales tax fee is 8.86%, putting Washington’s tax system twenty eighth total on the 2023 State Enterprise Tax Local weather Index.

Property taxes in Washington common 1.09%, rating twenty third. The state additionally levies an property tax on estates valued over $2.193 million, with tax charges starting from 10% to twenty%. Nevertheless, there may be an exemption threshold adjusted yearly for inflation, together with a $2.5 million deduction for family-owned companies valued at $6 million or much less.

Bucket #1: The Finest Three States With No State Earnings Taxes

Lastly, we attain the perfect three states to work and get wealthy, with no state revenue taxes. They’re Florida, Nevada, and Texas.

Florida (Democratic majority, however very shut)

Florida presents a top quality of life with a plethora of points of interest and facilities. The state enjoys a heat local weather year-round, excellent for outside actions like beachgoing, {golfing}, and boating.

Along with its pure magnificence, Florida boasts vibrant cities equivalent to Miami, Orlando, and Tampa, offering residents with entry to wonderful eating, leisure, and humanities venues. With quite a few parks, nature preserves, and leisure areas, Florida presents considerable alternatives for residents to guide energetic and fulfilling existence.

The price of residing in Florida is usually decrease, with moderately priced housing choices, items, and providers. For example, the median house value in Miami-Dade County is roughly $600,000, making it a sexy vacation spot for each working professionals and retirees searching for to maximise their retirement financial savings.

Moreover, Florida’s homestead exemption presents property tax reduction to householders, additional enhancing its enchantment as a retirement vacation spot.

Florida imposes a 6% gross sales tax, with localities licensed so as to add as much as 2%. On common, the mixed gross sales tax fee stands at 7.02%, putting it within the center vary in comparison with different states. The typical property tax fee is round 1.06%, rating twenty fifth in response to the Tax Basis.

Getting wealthy in Florida is extra possible as a result of a really optimistic enterprise tax local weather and loads of high-paying jobs in finance, cleantech, protection, IT, and life sciences.

Nevada (Democrat majority)

The state boasts a business-friendly regulatory local weather, with minimal purple tape and low company tax charges. This has led many companies to determine operations in Nevada, contributing to financial development and employment alternatives throughout varied industries. The tourism business stays Nevada’s largest employer, with mining persevering with as a considerable sector of the financial system: Nevada is the fourth-largest producer of gold on this planet.

The state’s pure magnificence is showcased by its beautiful landscapes, together with picturesque deserts, majestic mountains, and tranquil lakes. Out of doors fanatics can bask in actions equivalent to mountaineering, snowboarding, and boating, whereas city facilities like Las Vegas present world-class leisure, eating, and nightlife choices.

Housing costs in Nevada are typically extra inexpensive, permitting people to search out appropriate housing choices inside their finances. The median house value in Reno is about $550,000 whereas the median house value in Las Vegas is simply about $420,000.

Moreover, Nevada doesn’t impose inheritance or property taxes, making it an interesting vacation spot for retirees seeking to protect their wealth for future generations. Nevertheless, Nevada’s gross sales tax common is round 8.23%, which is comparatively excessive. So higher to purchase issues elsewhere. In the meantime, the typical property tax fee is simply 0.8%, ranked #30 in response to the Tax Basis.

Texas (Republican majority)

Texas presents a thriving financial system and ample employment alternatives throughout varied industries. The state’s business-friendly insurance policies, coupled with its strong job market, entice companies and professionals alike. Texas is house to various sectors equivalent to vitality, expertise, healthcare, and finance, offering a wealth of profession prospects for people searching for job alternatives or entrepreneurial ventures.

There is a purpose why firms equivalent to Tesla and Oracle have relocated their headquarters to Texas. In the meantime, Apple is investing billions in a brand new consider Texas too.

Along with its financial benefits, Texas boasts a wealthy cultural heritage, vibrant cities, and breathtaking pure landscapes. From the bustling metropolises of Houston, Dallas, and Austin to the serene fantastic thing about the Hill Nation and Gulf Coast, Texas presents one thing for everybody. Out of doors fanatics can discover its quite a few parks, lakes, and trails, whereas tradition aficionados can take pleasure in world-class museums, theaters, and music venues.

Texas presents a comparatively low value of residing in comparison with many different states, with inexpensive housing choices and an affordable total expense profile. The median house value in Houston is simply $272,000, $320,000 in Dallas, and $552,000 in Austin in response to Zillow. Austin house costs are at the moment going by a pullback.

The Texas state gross sales and use tax fee is 6.25 %, however native taxing jurisdictions (cities, counties, special-purpose districts and transit authorities) additionally could impose gross sales and use tax as much as 2 % for a complete most mixed fee of 8.25 %. Sadly, the typical property tax fee is 1.9%, #6 rank.

Minorities Might Have A Completely different Level Of View

One widespread assumption about states with out revenue tax is that they provide a welcoming setting for everybody. Nevertheless, this is not all the time the fact, notably for minority communities.

I had a white buddy who moved from San Francisco to Tampa Bay after promoting his firm for tens of tens of millions. He and his white spouse adopted three black kids and she or he needed to be near her household. Regardless of their preliminary pleasure, they determined to maneuver again to San Francisco after solely ten months.

Once I requested why, he defined that his kids confronted discrimination and bullying in Tampa Bay, which was not as welcoming to minorities as San Francisco, a minority majority metropolis. Cultural attitudes about completely different persons are merely completely different in every single place you go.

Personally, I’ve felt comfortable residing in New York Metropolis and San Francisco since 1999. These cities are so various that I do not stand out as a Taiwanese Hawaiian particular person. Nevertheless, throughout my time in Williamsburg, Virginia, and visits to different southern cities like Abingdon, I generally felt misplaced.

Whereas individuals have been typically heat, I encountered racism in high school and college in Virginia. Consequently, I’ve gravitated in the direction of extra various cities over extra homogenous ones The racial rigidity I felt additionally served as an amazing catalysts to turn into financially unbiased ASAP.

Cities That Require The Highest Earnings To Afford A Home

Now that I’ve ranked the perfect no state revenue tax states, it is time to drill all the way down to the perfect cities in these states. As soon as once more, figuring out the perfect cities in these no revenue tax states is subjective. Nevertheless, we will use goal measures to assist make a cogent argument.

As somebody who desires to earn probably the most cash and build maximum wealth, you wish to go to cities with probably the most high-paying jobs. You additionally wish to reside in a vibrant metropolis the place there’s heaps to do with out having to freeze your behind off for three-to-four months a yr.

To search out the cities within the no revenue tax states with the very best paying jobs, we will do a back-of-the-envelope evaluation by discovering which cities require the very best incomes to afford a house. In spite of everything, high incomes and high home prices go hand in hand. The rationale why houses are costly within the first place is due to the revenue and wealth alternatives accessible to its residents.

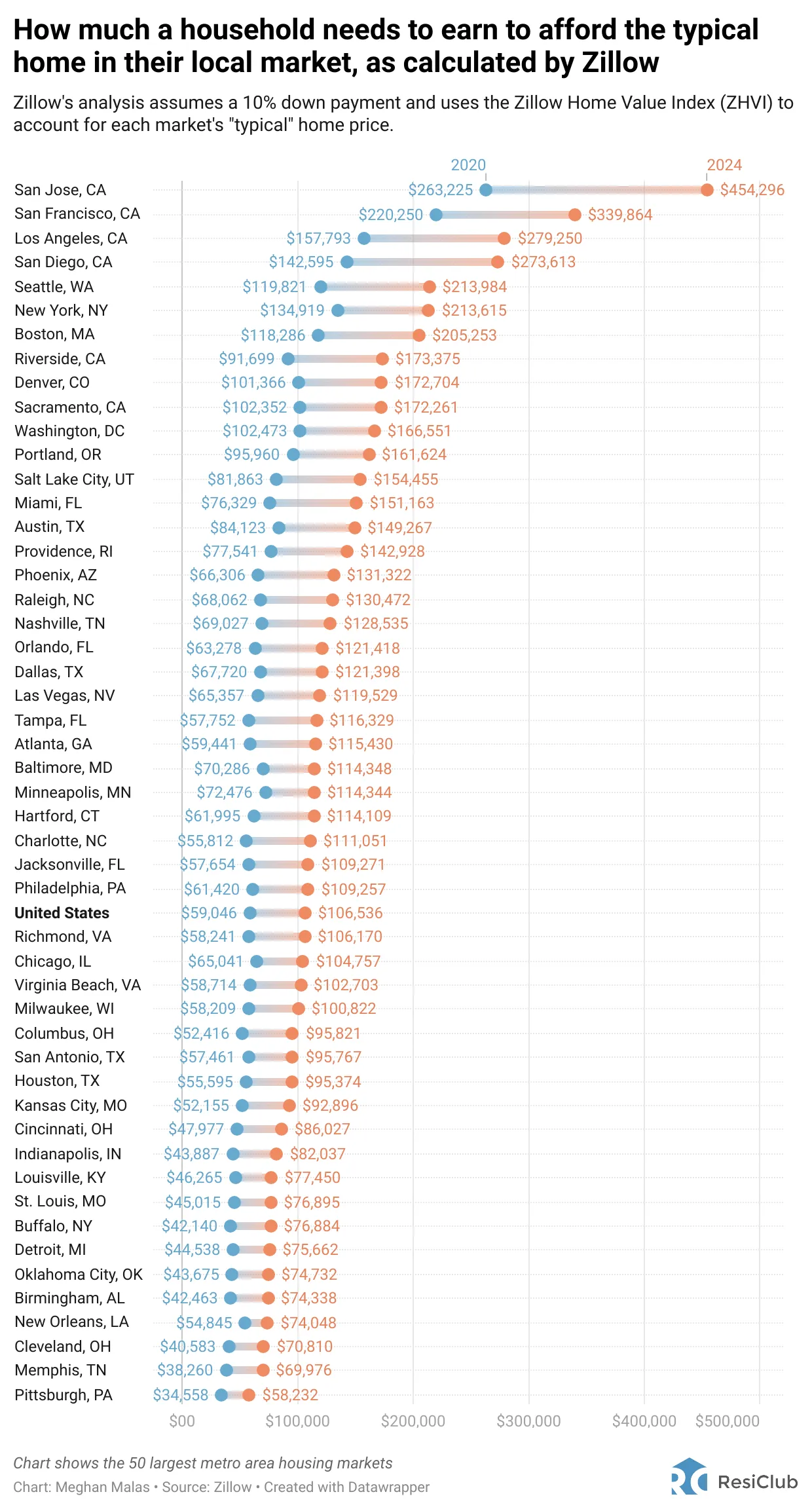

As a reminder, beneath is a chart that depicts how a lot a family must earn to afford the standard house of their native market, based mostly on knowledge from Zillow.

Prime American Cities To Get Wealthy And Pay No State Earnings Taxes

To establish the perfect cities, we simply establish the very best revenue necessities cities inside the 9 no-income-tax states. They’re:

- Seattle, WA ($213,984)

- Miami, FL ($151,163)

- Austin, TX ($149,267)

- Nashville, TN ($128,535)

- Orlando, FL ($121,418)

- Dallas, TX ($121,398)

- Las Vegas, NV ($119,529)

- Tampa, FL ($116,329)

- Jacksonville, FL ($109,271)

I cease at Jacksonville as a result of some other metropolis within the 9 no-income-tax states falls wanting the USA median revenue of $106,536. I am searching for cities with probably the most strong revenue alternatives within the nation.

Seattle Is The Finest No Earnings Tax Metropolis To Earn The Most

Seattle stands out because the premier metropolis with out state revenue taxes. What distinguishes it? The heavy hitters—Amazon, Microsoft, Starbucks, Deloitte, Windfall Well being, and plenty of different influential gamers name it house. Although the climate could not swimsuit everybody, if it is adequate for Invoice Gates, it is definitely value contemplating for the remainder of us.

Miami takes second place as a no-income-tax metropolis, having attracted tech expertise and venture capitalists. Nevertheless, the post-pandemic attract towards Miami has waned, as entrepreneurs and buyers acknowledge the optimistic community results of cities like San Francisco and New York.

In third place is Austin, drawing in new companies and migrants from pricier locales equivalent to San Francisco and Los Angeles. It is a magnet for giant names like Tesla and Oracle, attractive them to relocate their headquarters. At one level in the course of the pandemic, it appeared like everybody was shifting to Austin.

Upon reflection, I imagine these three cities supply probably the most strong job alternatives with the very best pay. Whether or not you are a part of the bulk or a minority, these cities have one thing to supply everybody.

Select The Finest Job First, Finest Metropolis And State Second

Whereas the enchantment of avoiding state revenue taxes could also be tempting, prioritize discovering the perfect job alternative first. If that occurs to be in one of many high no state revenue tax states, contemplate it a bonus. Nevertheless, if not, you’ll be able to all the time discover relocation choices after gaining extra expertise.

With distant work changing into more and more widespread post-pandemic, the chance to maneuver to a no state revenue tax state has expanded. Nevertheless it’s sensible to make such a transfer earlier than committing to buying a house, selecting colleges on your kids, and establishing robust social connections. As soon as these features are in place, relocation turns into more difficult.

Upon retirement, relocating to a no revenue tax state could appear interesting. Nevertheless, since your revenue is prone to be decrease in retirement, the tax financial savings will not be as important as whenever you have been working. At this stage, the transfer could solely be worthwhile when you’re motivated by elements like being nearer to grandchildren or having fun with higher climate.

Onerous For Me To Relocate After Being In San Francisco Since 2001

Personally, I worth residing in a metropolis with a reasonable local weather that allows me to take pleasure in outside actions year-round. As an avid tennis and pickleball participant, I am unable to do freezing temperatures in the course of the winter. And if it does snow, then there had higher be a unbelievable mountain to ski on shut by!

Cities like San Francisco, Los Angeles, San Diego, and Honolulu are amongst my favorites, regardless of their excessive tax charges. Luckily, Hawaii does not tax Social Safety and pension revenue.

Whereas I may doubtlessly lower your expenses by shifting to Austin or Seattle, I’ve no want or want to take action. My buddies are right here in San Francisco, and my household resides in Honolulu. Moreover, passive investment income is taxed at a extra favorable fee. Subsequently, I am content material the place I’m.

Nevertheless, for youthful people or these with substantial wealth, making a transfer now to save lots of on taxes may very well be a sensible resolution. Except life turns into insufferable in a high-income tax state, you will probably adapt to paying larger taxes and discover methods to make the perfect of the state of affairs.

Reader Questions

Which is your favourite no state revenue tax state and why? Which do you assume are the best states for retirement? Are you keen to relocate to a no revenue tax state to save lots of? When you have, I might like to understand how tough the transfer and the adjustment was. What are a few of the downsides of residing in a no revenue tax state? When you at the moment reside in one of many 9 no state revenue tax states, I might like to get extra of your perspective!

As individuals turn into extra cellular because of expertise, extra individuals ought to logically migrate to a no revenue tax state. Subsequently, I believe it is value investing in actual property in the perfect cities within the no revenue tax states. To take action, take a look at Fundrise, a non-public actual property funding platform that started in 2012. It primarily invests in lower-cost cities with larger rental yields. I’m personally an investor in Fundrise funds.

For superior money circulation administration and web value monitoring, discover Empower, a free wealth administration software I’ve trusted since 2012. Empower goes past fundamental budgeting, providing insights into funding charges and retirement planning. Keep on high of your funds as a result of there is not any rewind button in life.