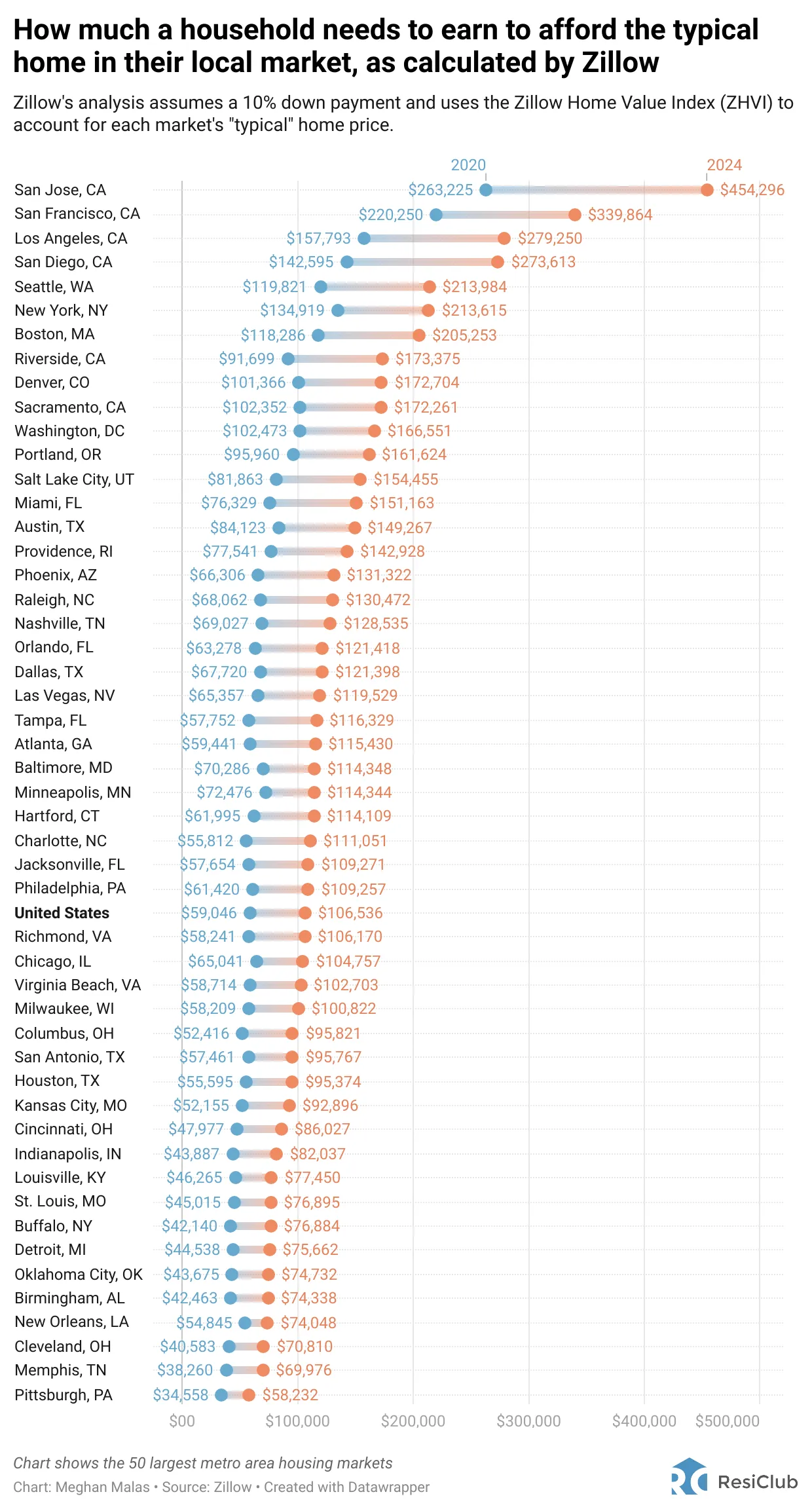

Zillow just lately launched an intriguing research that outlines the earnings wanted to afford a “typical dwelling” in numerous cities. The research considers a ten% down fee and makes use of the Zillow Dwelling Worth Index to find out the median dwelling worth in every metropolis.

A ten% down fee is decrease than my advisable 20% down fee primarily based on my 30/30/3 home-buying rule, however it’s Zillow’s train. Let’s evaluate the earnings required to buy the median dwelling in every metropolis between 2020 and 2024. These are the highest 50 metropolis metros in America.

San Jose instructions the best earnings requirement to afford a median dwelling at $454,296, whereas Pittsburg boasts the bottom earnings wanted at simply $58,232. If homeownership is a precedence and budget constraints are a priority, maybe a transfer to Pittsburgh, Pennsylvania, is value contemplating!

As a San Francisco resident, I discover it reassuring that the price of dwelling right here is simply $339,864. This represents a considerable $114,432 discount within the required annual earnings, or 25%, in comparison with the earnings wanted for homeownership in San Jose.

Moreover, relating to way of life concerns, San Francisco provides a extra picturesque, lively, and pleasant surroundings in comparison with San Jose. It is not San Jose that pulls world vacationers to the U.S., however moderately the attract of San Francisco!

Costly Cities May Truly Be The Least expensive Cities To Reside In

You’ve got learn my publish titled “Why Households Need To Earn $300,000 A Year To Live A Middle-Class Lifestyle Today.” Whilst you may need strongly disagreed with my evaluation regarding households residing in costly coastal cities, it is reassuring to seek out exterior validation from Zillow supporting it.

The US is huge, with various cost-of-living ranges throughout the nation. Happily, all of us possess the liberty to decide on the place we need to stay.

If the price of dwelling turns into too burdensome for our earnings, we’ve the choice to relocate, trim bills, or search extra work, as we’re all rational decision-makers.

Regardless of cities corresponding to Boston, New York, Seattle, San Diego, Los Angeles, San Francisco, and San Jose necessitating over $200,000 in family earnings to afford a typical dwelling, I argue that these cities are extra reasonably priced than generally perceived.

Listed below are two the explanation why.

1) Costly cities are cheaper to have enjoyable and stay more healthy

As I wrote in my publish about private sports clubs, I pay $180 a month to be part of a community of golf equipment within the Bay Space. I feel $180 a month is nice worth, which is why I am unwilling to chop the expense regardless of no longer being financially independent.

Then Nate, a reader from Pittsburgh, PA chimed in and wrote,

“Very bizarre a personal sports activities membership with indoor pickleball and tennis would solely value $180/m. Clearly you wouldn’t cancel this. There isn’t any such factor as non-public indoor sports activities membership for $180/month in Pittsburgh. Solely nation golf equipment with outside tennis or pickleball and golf for $1,500/m and up. Different choice is public park for tennis or pickleball which includes ready/no reservations/no availability.”

Holy moly! $1,500 a month and up to have the ability to play tennis and pickleball indoors? No thanks! Who can afford that?

$18,000 a yr for sports activities membership membership dues whereas it solely takes $58,232 in earnings to afford a typical home is an absurd ratio.

Nicer Climate Issues For High quality Of Life

Right here in San Francisco, the climate stays average all year long, offering ample free public courts for tennis and pickleball. On this instance, non-public sports activities membership memberships are at the very least 88% extra reasonably priced.

For these searching for cost-effective outside enjoyment nearly year-round, cities like San Jose, San Francisco, Los Angeles, and San Diego supply favorable situations. Nonetheless, in areas the place the required earnings is lower than the total U.S. earnings of $106,536 to afford a house, sustaining a year-round outside way of life is tougher.

Improved climate stands out as one of many essential the explanation why dwelling on the West Coast surpasses living on the East Coast. Having skilled each coasts for over a decade every, I can attest to the considerably greater high quality of life.

Life is already transient, and enduring three to 4 months of utmost winter situations yearly is suboptimal for a lot of People. Consequently, a considerable variety of People decide to relocate out west or south to Florida.

For these prioritizing favorable climate and homeownership, cities like New York Metropolis ($213,615) and Boston ($205,253) may not be the very best decisions.

Given their high-income necessities for housing and difficult climate situations, a strategic transfer might contain geoarbitrage to extra reasonably priced and hotter cities on the east coast like Miami ($151,163), Raleigh ($130,472), Baltimore ($114,348), and even Pittsburgh, PA ($58,232).

2) Costly cities are simpler to earn more money and thereby enhance affordability

I have been considering a transfer to Honolulu, Hawaii since 2014.

After retiring in 2012, I assumed, “Why not relocate to my favourite state in America?” The great climate, scrumptious meals, and laid-back vibe all appeared like components that might contribute to an extended and extra fulfilling life.

With sufficient passive earnings to maintain a easy way of life and the chance to generate supplemental retirement earnings by means of writing on Monetary Samurai, the concept appeared interesting.

Again then, with no children, retiring to Hawaii gave the impression to be a simple resolution. Nonetheless, my ardour for actual property made me really feel that if I had been to maneuver, I wanted to personal a house in Honolulu.

Simply as shorting the S&P 500 long-term is taken into account a suboptimal resolution, I believed that renting long-term and never proudly owning actual property in Honolulu may also be lower than ideally suited.

For 3 years, I diligently attended open homes in Honolulu throughout each go to to see my mother and father. Regardless of leaving every time excited in regards to the potential of relocating, I could not shake the worry that I may not comfortably afford to stay in Honolulu.

Honolulu Housing Is ~30% Cheaper Than San Francisco Housing

It may appear unusual to specific concern about retiring in Honolulu, the place comparable housing is about 30% cheaper than in San Francisco. Or is it?

My fear stemmed from the worry that if I bought a house in Honolulu and encountered surprising monetary difficulties, I’d discover myself in a decent spot. In 2014, my passive income was round $110,000, which was already inadequate to qualify for a standard mortgage for a median-priced dwelling in SF or Honolulu.

Given my lack of W2 earnings, I would wish to give you a down fee of fifty% or extra to purchase a house priced between $700,000 and $1 million. For context, the median dwelling worth in Honolulu is roughly $780,000, based on Zillow, however $1,075,000 based on Locations Hawaii, which appears extra correct.

And similar to all median dwelling worth estimates, they appear approach decrease than the price of the house you need to purchase!

Pay Is A lot Much less In Honolulu Too

Upon exploring the job market in Honolulu, I found that the pay was 40% – 60% lower than what I might earn in San Francisco. Furthermore, I wasn’t conscious of any engaging part-time consulting jobs in Honolulu.

In distinction, San Francisco boasted a plethora of consulting and full-time jobs paying $100,000 or extra. Right this moment, even 23-year-old school graduates working in tech, consulting, or finance can begin incomes $150,000 or extra yearly. It’s only logical the highest-paying cities even have the best value of dwelling.

In line with Numbeo, you would wish round $7,701 in Honolulu, HI to keep up the identical customary of life you can have with $8,900 in San Francisco, CA (assuming you hire in each cities). This calculation makes use of their Price of Residing Plus Lease Index to check the price of dwelling and assume after earnings tax.

Shopping for Actual Property In San Francisco Felt Safer Due To Increased Revenue

Though San Francisco dwelling costs are roughly 42% greater than Honolulu dwelling costs, I felt extra comfortable purchasing a fixer-upper in San Francisco for $1,230,000 than shopping for a home in Honolulu for $700,000 – $1.1 million. I managed to purchase the fixer in 2014 as a result of a few giant CDs matured, and my spouse was in her last yr of labor.

I used to be assured that if I confronted monetary difficulties after shopping for the fixer in San Francisco, I might all the time safe a six-figure job as a guide or full-time worker. San Francisco boasts an enormous tech ecosystem, together with biotech, medical, aerospace, and tourism industries.

In distinction, Honolulu closely depends on tourism as its essential supply of earnings. Due to this fact, financial challenges in Japan and China might adversely have an effect on Honolulu. Making money in Hawaii is just more durable than earning profits in San Francisco.

Shopping for a house in San Francisco felt safer as a result of range of industries and the supply of higher-paying jobs. The continuing artificial intelligence boom may improve the returns of my enterprise capital funds.

Moreover, if I did not stay in San Francisco, I in all probability would not have had entry to a few these non-public funds. All the highest tier enterprise capital funds are invite just for retail traders as a result of there may be a lot demand from institutional traders. Retail traders can solely acquire entry to the “family and friends” spherical of workers.

Simpler To Make investments In Personal Progress Corporations Right this moment

Fortunately, at present, all people who has $10 to speculate can put money into the Fundrise Innovation Fund, an open-ended enterprise fund that invests in non-public progress corporations within the AI area and extra. I am bullish on AI and I do not need my children asking me 20 years from now why I didn’t put money into the AI revolution close to the start.

Here is a dialog I had with Ben Miller, CEO of Fundrise about investing in non-public progress corporations, which had been as soon as solely accessible to ultra-high web value people and establishments, till now.

Extra Examples Of How Prices Are Increased In Cheaper Cities

Price of Automobiles: The worth of a Honda Accord stays constant no matter location. As an illustration, buying a $34,000 Honda Accord Sport would account for 58% of an $58,000 wage however solely 23% of a job-equivalent wage of $150,000.

Price of Supplies for Dwelling Transform: Lumber, sheetrock, wiring, and fixtures usually value the identical throughout the nation. Whether or not you are reworking a $500,000 home or a $1,200,000 home, the prices may differ (10% versus 5.8% of the house worth, respectively). Nonetheless, the higher-priced dwelling yields a higher return on the rework, contemplating the 120% greater worth per sq. foot.

Price of Faculty: Faculty tuition costs are constant nationwide. Nonetheless, the affordability of school has turn out to be difficult for middle-class households, significantly in cheaper cities, the place solely the wealthy or the poor can comfortably afford greater schooling.

Think about any product that maintains a constant worth no matter your location, and you will perceive why dwelling in a extra reasonably priced metropolis with a decrease earnings will be extra pricey.

Residing In An Costly Metropolis Is Like Taking part in Offense To Construct Wealth

In your journey to monetary independence, you have got the choice to play offense, striving to maximise your earnings, or play protection, aiming to save lots of as a lot cash as attainable. Most people pursuing FIRE (Monetary Independence, Retire Early), the motion I helped pioneer in 2009, undertake a mixture of each methods.

Personally, I favor enjoying offense in wealth-building, pushed by the limitless potential for earnings and funding returns. Since 2009, I’ve chosen to reside in New York Metropolis and San Francisco, recognizing the plentiful alternatives for greater earnings. This method is akin to investing in growth stocks within the first half of your life.

Not solely was I in a position to earn more money dwelling in NYC and SF, I used to be additionally capable of construct connections that granted me private investment opportunities, a few of which have turned out properly. Personal firm investments in names corresponding to Figma and Ripple have blown previous any inventory index return over the previous 10-20 years.

Whereas the price of dwelling in these cities is undoubtedly excessive, it is a reflection of the alternatives they provide. Proudly owning actual property in such high-opportunity cities, as soon as achieved, makes constructing extra wealth a lot simpler.

Relocate As soon as You’ve got Made Your Fortune

After accumulating enough wealth, one can ponder relocating to a extra budget-friendly metropolis that aligns higher with way of life targets and earnings ranges. It is simpler to maneuver from New York Metropolis to New Orleans versus the opposite approach round.

The earnings potential in an costly metropolis will be so substantial that the perceived drawbacks, primarily the excessive value of dwelling, turn out to be much less important.

In case you stay in an reasonably priced metropolis, all of the extra motive to capitalize on on-line earnings and do business from home alternatives. Happily, an rising variety of jobs now supply comparable wages no matter your location. Due to this fact, you may as properly take benefit!

Reader Questions And Solutions

Resides in an costly metropolis actually less expensive? Are folks overlooking the truth that these cities are costly due to the earnings alternatives they provide? Which cities do you suppose strike the very best steadiness between affordability and earnings potential?

I plan to proceed investing within the heartland of America, the place the price of dwelling is decrease and rental yields are greater. Technological developments will drive extra People to relocate to extra reasonably priced cities over the following a number of a long time.

In case you share this long-term demographic change perspective, check out Fundrise. Managing over $3.5 billion in belongings, Fundrise primarily invests in residential and industrial properties within the Sunbelt area. In case you select to stay in an costly metropolis, all of the extra motive to diversify throughout inexpensive components of the nation.

Fundrise is a long-time sponsor of Monetary Samurai and Monetary Samurai is an investor in Fundrise funds. Since 2016, I’ve invested $954,000 in quite a lot of non-public actual property funds and particular person offers to diversify away from my costly San Francisco holdings and earn extra passive earnings.

Monetary Samurai is likely one of the largest and most trusted independently-owned private finance websites with roughly 1 million natural guests a month. The positioning was began in 2009 with every part written primarily based off firsthand expertise.

Sam labored in finance for 13 years, bought his MBA from Berkeley, and has written over 2,300 private finance articles. He’s the WSJ bestselling writer of Buy This Not That. Be part of his free weekly newsletter if you wish to speed up your path to monetary freedom.